Answering 3 Common Questions About Commercial Flood Insurance

5/12/2021 (Permalink)

Commercial flood insurance can be a bit confusing. You have to purchase it separately from your regular property insurance. There are also some exclusions to most flood policies. Here are the answers to some common questions about this type of insurance.

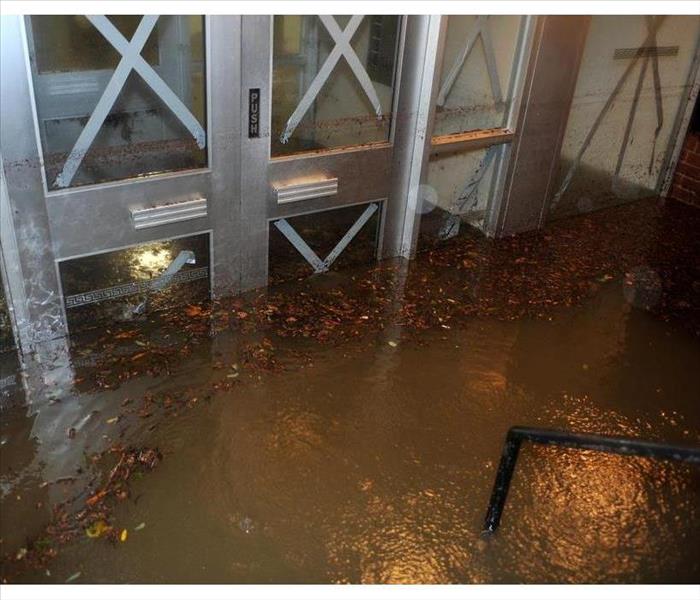

What Is a Flood?

Essentially, a flood occurs when water accumulates on dry land. However, the NFIP has a more detailed definition. The NFIP describes a flood as the complete or partial inundation of water on a normally dry area that contains either two or more properties or two or more acres. It can result from mudflow, runoff, or an overflow of tidal waters. Common causes of floods include:

- Broken levees or dams

- Heavy rain

- Fast-Melting snow

- Post-hurricane storm surges

What Does This Insurance Cover?

As its name implies, flood insurance protects your property from flood damage. You can only purchase it from the NFIP, which offers up to $500,000 in-building coverage and up to $500,000 in personal contents coverage. This money can go toward emergency restoration services.

Building coverage includes harm that occurs to the actual structure, including the HVAC, plumbing and electrical systems. Contents coverage, meanwhile, pays for damage to furniture, equipment and other items inside the property.

While flood policies are fairly thorough, there are certain exceptions. Any property outside your building, including company vehicles, is typically excluded. Insurance also will not cover damage to precious metals or currency.

Who Has To Buy This Insurance?

Many business owners should consider purchasing flood coverage since it is not included in typical commercial insurance policies. However, if your company is in a high-risk flood zone and has a mortgage from an insured or federally regulated lender, you are required to purchase flood insurance.

The NFIP lets business owners purchase flood coverage for both their building and the items inside it. This insurance could keep your Chalfont, PA, company afloat following a storm.

24/7 Emergency Service

24/7 Emergency Service